Seoul, South Korea – When Alex looked into the price difference between rhinoplasty, commonly known as a “nose job”, in the United States...

France looks to boost export financing to help mid-sized defense firms

[ad_1]

PARIS — French public investment bank Bpifrance is seeking to increase the amount of export financing it can provide to small and medium-sized defense firms, as the current limit is insufficient to meet some demands, the bank’s head of export finance said.

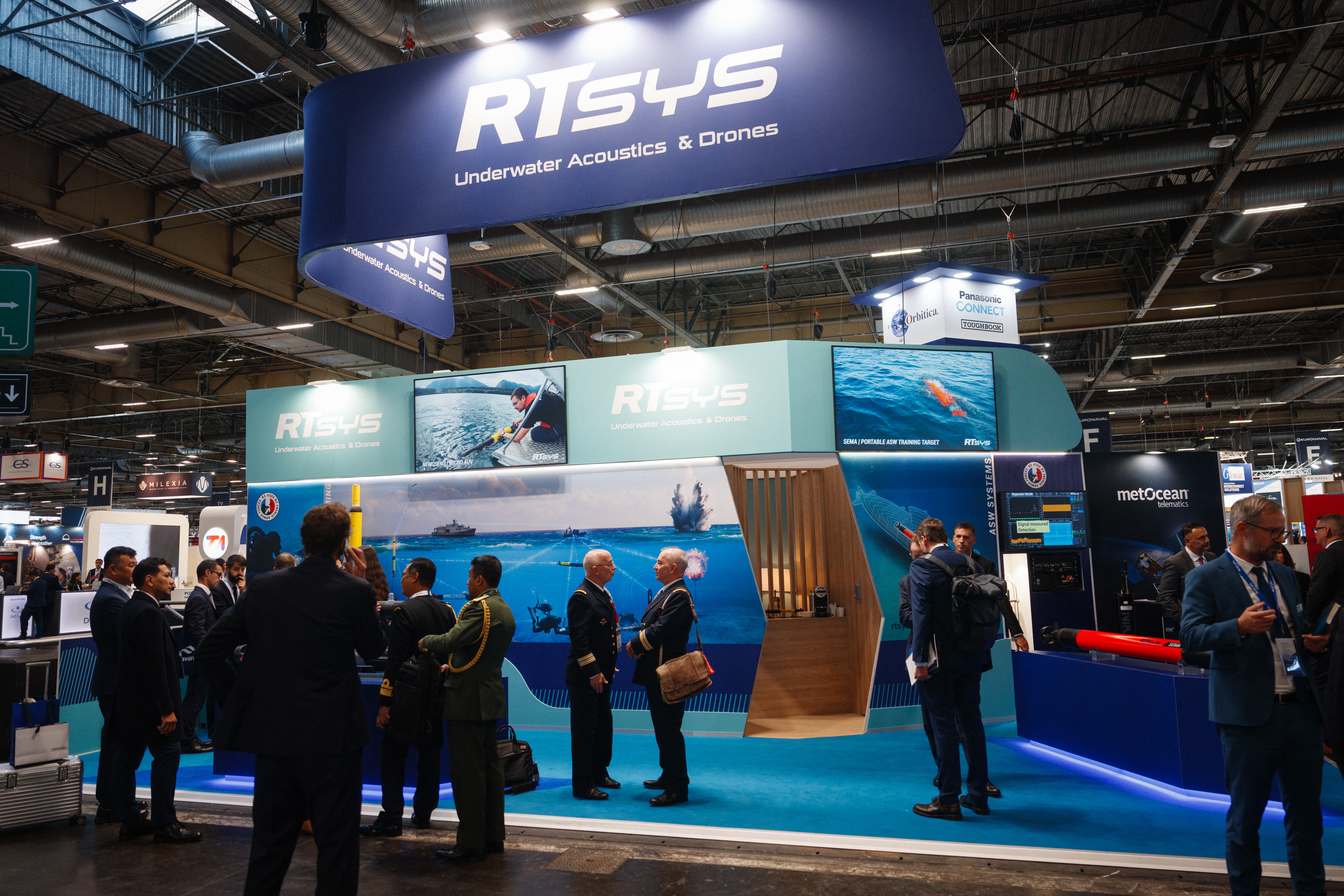

Bpifrance currently provides up to €25 million (US$27 million) of financing for export deals when it’s acting as the single lender and would like to raise that to around €40 million in 2025, Hugues Latourrette, the head of the Bpifrance export-finance department, told Defense News at the Euronaval show outside Paris.

“We’re pushing in that direction because we feel there’s a need,” Latourrette said. While Bpifrance’s limits on export financing affect only a few companies for now, “due to the dynamics of the industry, it’s something that could evolve rapidly.”

The public investment bank fills a market gap, as few large commercial banks are interested in providing small and medium-sized exporters with financing for amounts below €40 million, according to Latourrette. He declined to provide details on the companies seeking export financing from Bpifrance, citing reasons of confidentiality.

Foreign defense markets are “extremely competitive,” and manufacturers from Turkey, South Korea and Israel “can make life difficult for our manufacturers in France,” Latourrette said during a forum discussion at Euronaval. A commercial and technical proposal is not necessarily enough to win an export deal, and often needs to be accompanied by a financial offer, the banker said.

France was the second-largest arms exporter in the 2019-2023 period after the United States, accounting for 11% of global arms exports, according to data from the Stockholm International Peace Research Institute. The country has around 4,000 small and medium-sized defense-industry firms, according to the Armed Forces Ministry.

Bpifrance helps defense exporters win contracts, including through financing deals on the African continent, and the bank is involved in export negotiations in Europe, Latourrette said. The bank only provides financing in euros, and doesn’t engage in dollar transactions for reasons of extraterritorial action.

Rudy Ruitenberg is a Europe correspondent for Defense News. He started his career at Bloomberg News and has experience reporting on technology, commodity markets and politics.

[ad_2]

Source link